Look at my last newsletter from March 31 where I told you it’s going to happen and now it started. I’m in Real Estate since 1984. Before Corona I seriously thought I’ve seen it all, but nobody has seen what’s coming now. Nobody can tell how bad it’s going to be, but you can either be an optimist and use this situation to your advantage or you can be a pessimist losing money.

Is your glass half-full or half-empty?

In my last letter, I told investors to wait. I’m still telling you the same. The market is turning, but I think there is still plenty of room to go down. I don’t know if it gets as bad as back in 2008 where I made a fortune when homes sold for under $100.000 for which I since then receive between $950 – $1,350 rent per month. These homes are long paid off by the tenants and I sold a few for more than double the purchase price. In 2008 it was a local crisis initiated by greedy lenders. This time it is a worldwide crisis which should be a signal this one could even be worse.

How bad?

Nobody knows. Whoever is telling you they know they actually don’t. But thanks to our great MLS system, I can base my decisions on facts. I have learned to leave all the speculations to our President. For our local market, I can show you the facts and it will be completely up to you what you do wit this knowledge. Back in 2008 a lot of people made some decent money following my advice. This is what I do:

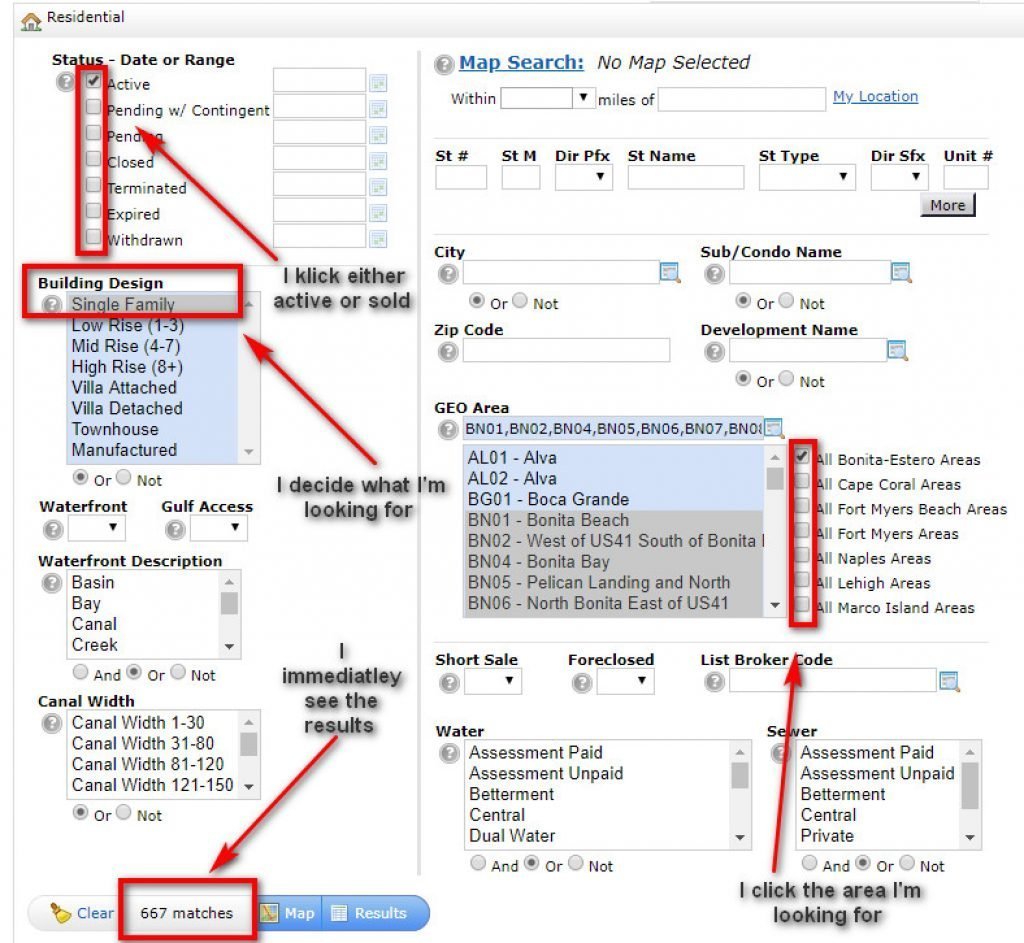

In this particular example, it shows right now there are 667 single-family homes in Bonita on the market for sale.

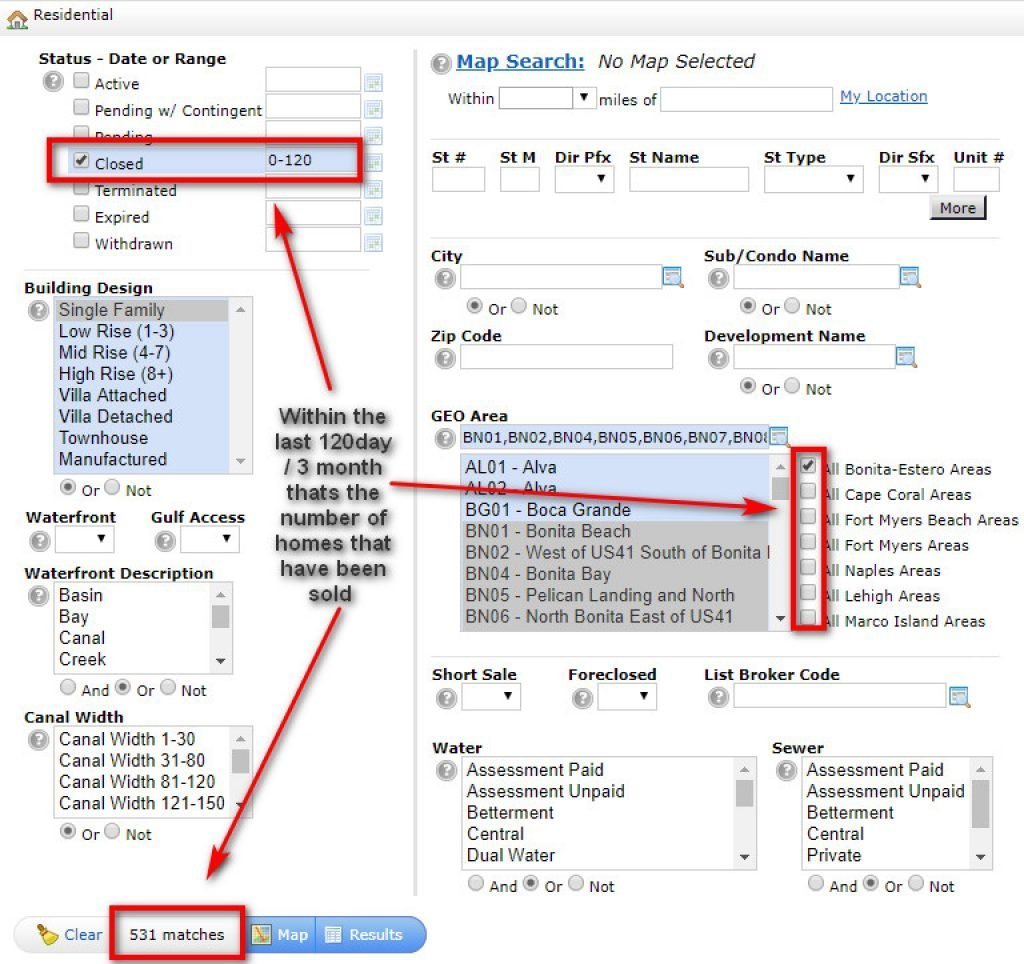

This picture shows us, 531 homes in Estero have been sold in the last 3 months. Divide this number by 3 and you get your overall sales of Singel Family homes per month. This ads up to 177 homes in overall sold per month. I can now reduce the sales period to any other number. That’s how I check how many homes have been sold within the last month. This will give us an idea of what’s going on in the market. If I only look at the last 30 days how many homes have been sold in Estero, this number is 124 or 15.17% less than overall. Demand is going down.

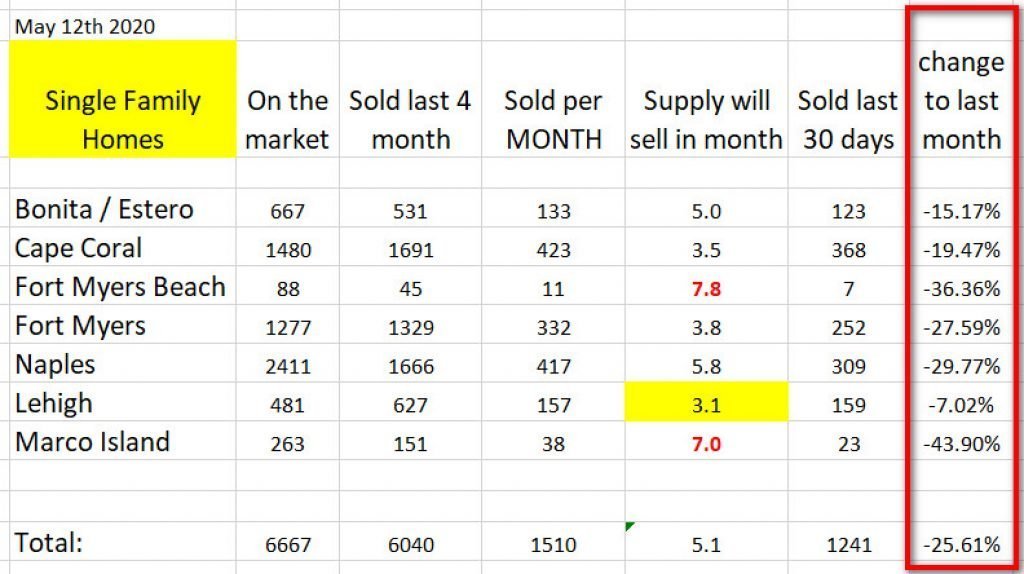

This is how the other areas are looking:

On average 25.61% fewer single-family homes have been sold within the last 30 days. Take a look at Appartments where it’s a little worse:

The average sales reduction for single-family homes and Apartments located on any kind of waterfront is 30%.

And how are sales prices doing?

The rule of supply and demand always works. Yes. But only in a market that isn’t artificially supported or manipulated as we see it right now. It is kind of weird why sales prices are not going down like crazy. In 2008 the banks made the situation worse when they didn’t work with their customers and forced everyone in default to sell their homes. This time it is different. With this global crisis, it’s not up to the banks alone anymore. This time they work with the Government and they worked out a deal where each homeowner can postpone their mortgage payments for up to 12 months. This is why prices are not dropping like rocks – yet!! Right now you see a few price reductions here and there, but nothing major. Will prices come down at all?

Let’s try to analyze this?

Try to put yourself in the following position: You are a homeowner with a mortgage and you have lost your job to Corona. You don’t have to pay your mortgage for the next 12 months. Right now you are in good company: A little over 14% of all Americans don’t have a job. Estimates suggest this number will go up to about 20%

- Will you save money to make up these 12 months?

- Are you going to drastically reduce your spending and change your life?

- Do you think the economy will be back the same within 12 months?

- Do you expect the value of your home to be the same in 12 months?

- Are you sure you will still have a job in 12 months?

If you positively answer at least 2 of these questions, chances are, the market won’t crash too much. But let’s honestly face it: It will!! That’s why I renew my position: If you got cash and if you are looking for a great investment, be a vulture and keep waiting. Chances will show. I will let you know when it’s time to go all in. Perhaps you will become one of my customers who bought the following homes between 2007 – 2009 and now get this:

- Lehigh: Purchase $56.000 – rent $950

- Lehigh: Purchase $78.000 – rent $1.100

- Fort Myers: Purchase $81.000 – rent $1.200 – sold for $179.000

- Cape Coral: Purchase $91.000 – rent $1.350

- Cape Coral: Purchase $99.000 – rent $1.400 – sold for $195.000

- Cape Coral: Purchase $109.000 – rent $1.900 ( Poolhome ) – on the market for $325.000

I could to on an on. All these homes have been paid off by the tenants. Even with all the necessary maintenance and repair, they are now free and clear or sold for a great profit. Where else can you get this kind of return on your investment where you can even write off trips to Florida as expenses? Call or email me any time for further references, help, and updates.