I’ve posted enough reasons why the market is supposed to ( or even HAS to ) adjust, but it’s not happening. The opposite is happening: The market is going up and not just a little. Here are a few interesting numbers:

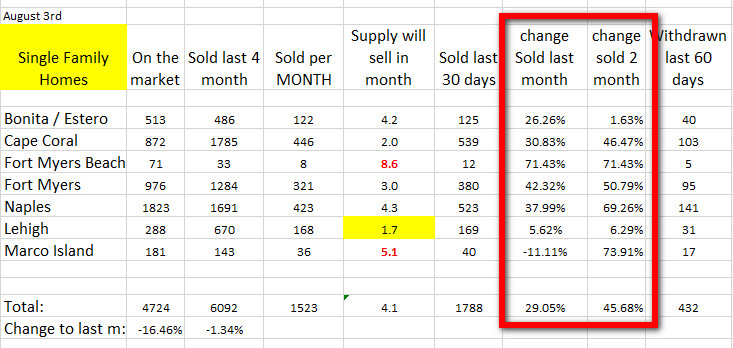

As a reader of my blogs you know I’m checking the supply and demand of homes every 4 weeks. Go check the previous inventory 4 weeks ago in my last blog. Within the last 30 days we have sold this many MORE single-family homes in these areas:

- Cape Coral: + 30.83% MORE = 539 homes

- Fort Myers: + 42.32% MORE = 380 homes

- Naples: + 37.99% MORE =523 homes

- Bonita / Estero: + 26.26% MORE = 125 homes

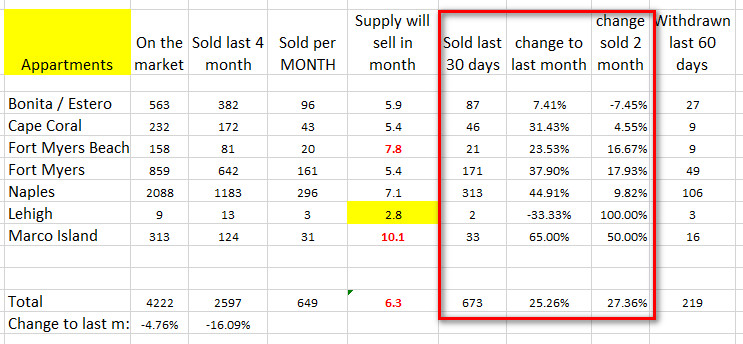

That’s for single-family homes SOLD within the last 30 days. Here are the numbers for Apartments SOLD within the last 30 days compared to last month:

- Cape Coral: + 31.43% MORE = 46 sales

- Fort Myers: 37.90% MORE = 171 sales

- Naples: 44.91% MORE = 313 sales

- Bonita / Estero: + 7.41% MORE = 87 sales

Does this look like a crashing market to you? If we are honest: Not at all. That’s why I started to investigate the reasons for such abnormal behavior. What do other people know where I have no clue about. I started asking me the following questions:

- Was I looking at it from the wrong perspective?

- Will it still make sense to wait until I invest in real estate again?

- How will banks and lenders handle the forbearance once they run out?

- How bad will the impact from tenants not paying their rent be for the Real Estate market?

Am I looking at it with the wrong perspective?

For me it was as clear as never before: with this many people losing their jobs and so many people not paying their mortgages and their rent, the market has to collapse. This is simply common sense.

Shall I keep waiting or buy now before the market goes upo even more?

The facts mentioned before clearly state that waiting for the crash is the best decision, but the numbers of real estate sold within the last 30 and even the last 60 days speak a totally different language. Not only more homes were sold, but also the DOW and Nasdaq are going up like crazy. What is going on? Is everyone completely blind? Am I the only one capable of reading the facts? For my investigation, I started to look into the mortgage forbearance rules because for me this seems to be the biggest problem next to the high unemployment numbers.

Forbearance and unemployment:

This week the lowest number of forbearance was reported: “ONLY” 7.7% of all mortgage owners have not been able to pay their mortgage. SERIOUSLY: That’s supposed to be a good number? These 7.7% equal 4.1 million households who care not paying their mortgage right now. 4.1 Million!!! With the unemployment rate still on the rise and Corona not going away, all the experts agree: These numbers could rise even more. Making things worse: The weekly unemployment check of $600 ran out end of last month and the Government hasn’t reached a deal on how to help these families to survive. Even with the unemployment checks coming in, they usually only cover about 50% of the people’s regular income. Mortgage rates often are close to 50% of people’s income. No wonder they can’t pay. I needed to find out more about how banks and lenders will handle these repayments from their mortgagees. Here comes a quick overview:

If you’ve been affected, you are entitled to forbearance for 12 months

Lenders will start with a shorter plan and reassess at the end of the period to see if the financial situation has changed. However, if mortgagees are still unable to make full payment, they are entitled to up to 12 months of forbearance if they request it. This looks like a game-changer for me. I was under the impression forbearance is a one-time approval and the payments have to be paid back over a period negotiated between lender and mortgagee after. But here is how it will be handled:

Your payments are suspended in forbearance – but mortgagees must pay the money back in the future

During forbearance mortgage payments are suspended until the end of the forbearance period, whether it’s one month or 12. If mortgagees can make partial payments during forbearance, it will reduce the amount outstanding at the end of the forbearance period.

Mortgagees are never required to pay back their forbearance in a lump sum

Here are several options mortgagees have to repay the money they owe, based on what’s best for them. These include:

- Full repayment, known as reinstatement, where they pay back the missed payments.

- Repayment plans, allowing them to catch up gradually while they are paying their regular monthly payment.

- Resuming normal payment, when they can’t afford an additional amount but can resume making their normal monthly payment, lenders can leverage alternative ways for them to pay back the suspended payments in a manner that is affordable.

- Modification of the loan, when they have a sustained reduction in income resulting from the crisis, lenders can look at a modification (changes to the terms of your loan) that might suit their new circumstances; those changes will aim to reduce their original monthly payment amount.

Loan servicers are supposed to reach out to their customers about 30 days before the forbearance plan is scheduled to end to determine which assistance program is best for them at that time—a repayment plan, loan modification, or even an extension of the forbearance period if needed.

Summary:

When we look back at the housing crash 2007 / 2008 everything was chaotic. Lenders only acted according to their statutes. If payments came in late, the ( foreclosure ) process got started. No matter the circumstances. No negotiation. This behavior has cost them dearly, but they got bailed out by the State. Back then we have seen 1.6 million foreclosed homes. This number gives you an idea of why lenders hang on to every loan even if mortgagees aren’t paying. 4.1 million loans are in jeopardy. That’s 150% more loans than in 2008. This time lenders probably figured the Government can’t come to help. The money simply isn’t there. Covid has crashed the whole economy and not just the Real Estate market. They needed to act smarter. They don’t want to become owners of these homes in jeopardy. That’s not their business. Their business is lending money. And that’s what they do. Interest rates are at a historic low. I’ve seen 1.875% for a 15 year fixed loan. People are buying homes. Period. According to the payment plans mentioned above, I think it’s safe to say lenders will keep extending forbearance or modify loans if possible to avoid another crash. That’s why the market might NOT crash.

Outlook:

I didn’t assume current increased sales were made with high down payments. I assumed it’s the opposite. In meetings with friends and colleges in the last few weeks, my assumption was confirmed: Most of our buyers have asked for loans with mostly low ( Zero to 3% ) down payments. We have been there. That isn’t good if the market drops, but this time lenders probably will just keep their hands still and won’t force people into foreclosure. My take: I’m going to start looking for at least one more home right now. I know: It’s a little like Russian roulette. But if you think the market might still crash then opt to buy some options for falling markets. This way possible real estate downturns losses will be caught by these options and you have invested in assets either way.