The answer to this question must be split: I subtly notice an increased building volume, especially in apartments in multi-family houses, and I also wonder whether this can go well for a long time to come. In such cases, facts help to find the truth about the market.

Important:

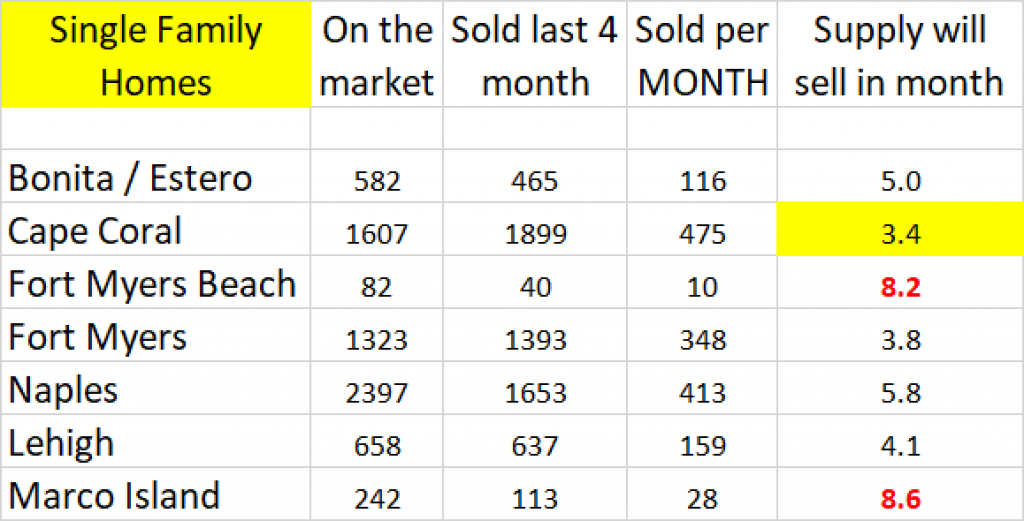

The first thing to do is to establish how many properties are currently being offered for sale on the market and how many have actually been sold in recent months. Thanks to the completely open MLS system, every broker can check and confirm these facts himself. Release 10 October 2019

For single-family houses, it takes an average of 4 – 5 months for the entire stock to be sold at current demand. In Cape Coral it is only 3.4 months and on the islands, it takes much longer. It is similar to apartments. Also here Cape Coral is ahead again. Only in Lehigh, it goes still faster to sell the only small stock. This is not a reliable value, as really only very few apartments are offered in Lehigh.

For Europeans, single-family houses in the water are of particular interest. The facts are quite clear: Cape Coral and Lehigh are far away from the islands. This is mainly due to the much higher prices for waterfront properties in Naples and Marco Island.

Restriction:

Only completed properties are included in this list. Especially in Fort Myers many new apartments are being built. Most of them should be finished during the high season and sold to “Snowbirds”. I myself know approx. 1,000 dwellings in the foreseeable future into the market to come. If the number of the sales should remain the same, then a supply of approx. 10 months results. This is a value that gives a reason for concern. Since freehold flats for the holidays letting hardly come into question and often unreasonable high additional costs have those not to the tenants to be passed on are, is not to be counted on an intensified purchase of these objects by Europeans.

My conclusion:

FOR NOW it does not look like the market is correcting considering these facts. The problem of condominiums remains to be observed and their sale to be awaited. Who therefore waits for a price collapse in order to be able to enter favorably, must practice itself in patience. If you consider to puchase or to invest, a personal consultation makes sense in order to shed light on the advantages and disadvantages of this strategy in detail and according to your specifications.