Americans find it difficult to understand European investors when problems such as non-payment of rent and, in bad cases, even nomadic tenancy arise. We actually almost don’t know such a thing in the USA. We will show you where the differences lie:

In general, it should be noted that the rights for rentals in the USA lie with the owners. Of course, tenants also have countless rights, but when it comes to unpaid lease payments, landlords in the U.S. do not have to stand idly by and often wait many months for often uncollectible payments. Here everything goes a little faster because for damage s up to $5,000 everyone in the US can go and claim it losses through a small claim court. Its a fast court process where you usually don´t need a lawyer to be present. experienced ex-lawyers and judges hear both sides in a court of arbitration and make suggestions on how a judge ruling might go. More info about the small claim court process can be found here.

https://www.leeclerk.org/courts/small-claims

Let me show you the difference in both countries:

This is how it works in Europe ( especially in Germany )

- The tenant doesn’t pay rent.

- The landlord warns and sets a deadline. Nothing happens.

- Landlord sends the next reminder and sets a new deadline. Nothing happens.

- Landlord threatens with a lawyer, and sets a final deadline. Nothing happens.

- Landlord hires a lawyer. The lawyer writes a letter with a new deadline asking for payment from the tenant. Nothing happens.

- The lawyer writes another letter. Again he sets another deadline. Nothing happens.

- The lawyer announces the court date. Nothing happens.

Until we reach this step, often up to 4 months passed in which the landlord not only did not receive any rent but also had to pay the additional costs of the property to the property management. FINALLY, it comes to a court hearing. Since the tenant has not fulfilled his obligations, the outcome of such negotiations is quite often certain: The tenant is sentenced to the payments for rent, incidental expenses, interest and lawyer’s fees. Great. The rule of law has won. Theoretically….. But what if the tenant still does not pay? The landlord will be held responsible for all previous AND coming costs and expenses. After further often long periods it will come to forced eviction. Of course, the landlord also bears the costs for this again. Often tenants have disappeared without a trace on the day of the eviction. In this case, the landlord even has to pay for the costs of evacuation and storage of the furniture left behind. A nightmare for everyone who has experienced it. Loss of rent of 12 or more months (depending on how quickly the landlord reacted at the beginning) is the rule. The legal advice costs cause further costs which can never be collected again. Who has experienced this wants to hear from further lettings often nothing more.

Now let me show you how the same scenario is treated in the USA:

- The tenant doesn’t pay.

- The landlord sends a reminder after 12 days and sets a deadline. Nothing happens.

- The landlord sends another reminder and threatens to go to arbitration. Nothing happens.

Until this deadline max. 1 month has passed. For these cases, the landlord has a 1-month rent deposit. Thus no damage has occurred yet.

- The landlord goes now to the arbitration court. His court date is usually set no later than 3 weeks from now .

The costs for it amount to approx. $300. Depending upon the height of the outstanding amount also a little more.

- The tenant receives the court appointment PERSONALLY through the local sheriff. That leaves an impression.

After max. 2 months both parties meet at the small claim court for negotiation. Since we always collect the last month’s rent for our landlords in addition to the deposit, the landlord actually still has no loss of rent. The outcome of this arbitration procedure is always the same: The tenant is sentenced to payment with a single, but short deadline. It also happens tenants do not pay then as well. The landlord than simply takes his judgment back to court and tells he hasn’t received payment. The court immediately orders the eviction. This decision is handed over to the tenant again by the Sheriff personally. Often the tenants have already disappeared by this time. The sheriff visibly clamps the note to the front door, which is clearly visible to every passer-by just because of the red color of the paper. The eviction takes place within a few days afterward. This is carried out by 2 sheriffs in the presence of the landlord. If the tenant is still in the property, he will be arrested right away. If he has disappeared, the landlord has now received his property back legally and can immediately re-rent it. The landlord can keep all furniture and everything else in the property or put it on the street as bulky waste. The maximum loss of the landlord amounts to approx. 1 month’s rent plus low court costs plus any possible damage to the property by the tenant. In contrast to Europe a dream state.

Not only the rights of the landlord are better in the USA – also the yield: 10% per year are the rule.

Single-family houses are often unaffordable in Europe and not suitable as a yield property. This is why apartments are usually rented throughout Europe. In the event of a loss of rent, the owner must also pay the ancillary costs. Especially in our region in Florida, however, detached single-family houses are the better yield. Reasonable properties are already available from $150,000. Depending on location and condition, you get between $1200 – $1600 rent per month. In the table, I have calculated a small example, what kind of expenses and incomes you can count on based on a property purchased for $200,000. I have calculated price and value increases at 6%. The costs for the acquisition of the tenant are only incurred in the 1st year:

| 1st year | 2nd year | 3rd year | 4th year | 5th year | |

| Property value | 200.000 | 212.000 | 224.720 | $238.203 | $252.495 |

| Rent per year | $18.000 | $18.000 | $19.200 | $19.200 | $20.352 |

| Taxes per year | $3.250 | $3.445 | $3.651 | $3.870 | $4.102 |

| Realtor fee | $1.500 | 0 | 0 | 0 | 0 |

| Insurances | $1.800 | $1.908 | $2.022 | $2.143 | $2.271 |

| Maintenance | $200 | $220 | $240 | $260 | $280 |

| Management | $1.200 | $1.200 | $1.300 | $1.300 | $1400 |

| Profit | $10.050 / $837.50 | $11.227 / $935.58 | $11.987 / $998.91 | $11.627 / $968.91 | $12.299 / $1.024 |

- Average return on rental income: 5.72%. This is at least 5.72% more than on a savings account in Europe or even more on a negative interest rate policy.

- Rental income in 5 years: $ 57.190 that is approx. 30% on the invested capital

- Increase in value of the object: $52,495

- Total revenue/profit after 5 years: $109,685 – that’s almost 55% on invested capital or 11% per year

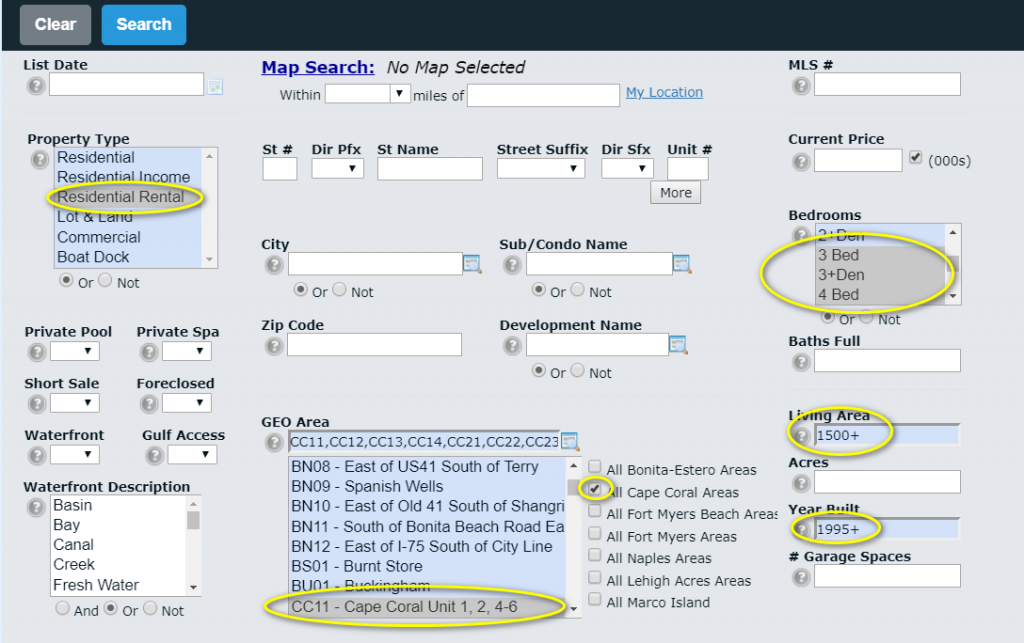

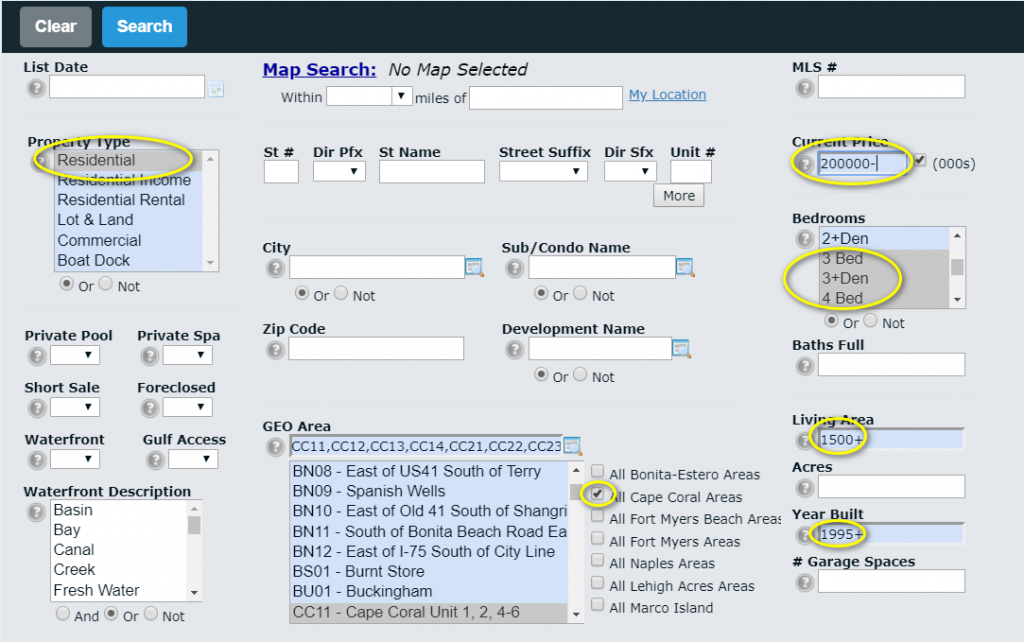

I understand that you are a little hesitant to believe these numbers. Thanks to the MLS search system in Florida, which is freely accessible to everyone, you can see for yourself. On my website under “Homebuyer” and Option 1 you have the possibility to verify the possible rental income yourself. I have searched for properties in Cape Coral with min. 3 bedrooms and a min. 1.500 sq ft ( approx. 140 m2 ) living space, which should not be older than 25 years. The input looks like this:

And to find out how many properties are currently for sale in our area up to $200,000, you can easily test with these specifications on the same page:

When I checked today there were just under 1,000 properties in Cape Coral for less than $200,000. A dream for investors and all wannabees. Feel free to try different entries on my site and feel free to contact me if you have any questions.

One more word about financing:

Financing, in general, is possible for foreigners in the USA with equity capital of at least 25%. The interest rates are much higher than in Europe. In addition, the bank charges (closing fees ) a quite high fee for the mediation of such a loan. In addition, the processing is lengthy and complicated. If you don’t want to miss our bargains and are dependent on financing, the procurement of the money via Europe is a much cheaper way.

Since 1994 I have been renting properties in Florida myself. So far there has only been 1 case where the arbitration procedure had to be applied. As a property manager, I take over the search for suitable tenants. I perform a detailed background check for the costs of which the tenant himself pays. Suitable tenants must always hand over 3 months’ rent before moving into an object. This covers the 1st month, the last month and the deposit. This procedure alone ensures that you hardly get any defaulting tenants. Whoever has this much money usually also have sufficient income to pay further rent.

Conclusion:

Do it. Do it now. Negative interest for money in the bank in Europe is a clear sign. Don’t leave your money rotting away. I’m here for any questions you might have. Call me

Here all links again:

– Info about arbitration court: https://www.leeclerk.org/courts/small-claims

– Link to MLS on my page: https://floridasouthwestrentals.com/home-buyer/