Are there differences? Oh heck yes….! Huge differences. Keep reading.

Americans are used to deal with Brokers / Realtors nearly every time when buying and selling Real Estate. Germans not so much. This Blog talks about the reasons and the huge differences in these 2 countries.

In the USA Realtors are educated, trained, incensed and insured and therefore somehow nearly on an equal level like attorneys or at least official professionals. In Europe, everyone can purchase a Real Estate license. It’s as simple as it gets: You need no education or continuing training, and only very few licensees are insured. They are somewhere on the level of car salespeople or vultures. Therefore let’s take a closer look at the differences:

US clients:

In nearly all states in the US buyers don’t have to pay their Broker to help them locate a property and deal with the paperwork and closing. The seller is responsible for the total commission. It would therefore actually be kind of stupid for any buyer NOT to hire a Broker. Each party has its own agent: The seller has his agent and he pays the full commission once a buyer was located and the deal closed. The buyer has his own agent who does not cost him a dime no matter if he finds him a property or not.

The seller’s agent only represents his seller and the buyer’s agent only represents his customer. The seller’s agent will be paid the full commission from his customer once the property sells. This means buyers won’t safe anything if they are not represented by their own agent because the seller’s agent has to spill the commission with the buyer’s agent. While under contract with the sales agent, buyers are usually not allowed to sell the property to anyone privately.

What about For Sales By Owners?

Yes, these properties are out there, but in order to understand why such properties usually are not a good deal, you need to understand how Realtors work and how they are educated.

How Realtors are born:

I was a Realtor and custom home builder in Germany from 1984 to 2005 before we moved to Florida. In order to sell real estate to customers in the States, I had to go through the same process as everyone else. No shortcut for anyone. No matter how old or how experienced you are. You get the same treatment as everyone else. This means you have to go to school for 2 long weeks. Sounds easy, but it’s not. There is a lot to learn in these 2 weeks. You then have to pass a class exam and after that comes the State exam. that’s a tough one and the failure rate is about 65% of all who try. I know a few people who never passed the exam and therefore aren’t allowed to sell real estate. Once you passed the exam you are a “Sales Associate”. You have to split a commission with the owner of the office – called the Broker and you can’t open your own office yet. You have to work under an experienced Broker fore at least 24 months. Then you could open your own office, but you still need to have a Broker in the office. This means you would have to split your commission.

The only way you don’t have to split your commission is to apply for your own “Brokers” license. For this, you have to go back to school again. Longer this time. Harder this time. Pass the school exam and the State exam and you are your own boss who can keep 100% of everything he or she earns. The failure rate is even higher this time. On top of this, all sales agents have to attend and pass their continuing education in order to keep their license active. Each sales agent has very high liability insurance. Usually 2 million coverage. Statements we make better be 100% correct. If not, customers can easily sue us and are covered through this insurance. Wouldn’t it therefore be stupid not to hire a sales agent if you want to purchase anything?

And in Germany?

There is a soft background check for applicants, but as long as you haven’t been in jail, killed anyone or have a background in tricking customers, chances are good you will receive your license. No training offered or required, no liability insurance and no regulation at all. Like selling cars – right? Everyone can do it.

Access to listings

In Europe, each Realtor has his own listings. Thanks to the internet, it is now a bit easier to find a property, but you might have to see several Brokers before you can close a deal. It’s not clear who is paying the commission. Sometimes its the buyer, sometimes the seller, sometimes both of them. One thing is sure though: No commission ain’t no option even if it’s advertised that way. In Europe, there is no law forcing Brokers to reveal if they are getting paid from both sides or if they have rolled in the commissions into the sales price of the property. Yes, that’s considered legal there.

Comparables:

In Europe, it’s tough enough to find comparable properties. Most properties vary a lot in style, size, and location. You might have a chance at Condos and Duplexes since they are built often and relatively equal, but there is no system to find such sales. You can try to go online and find sales, but you won’t find specific data. Therefore sellers can pretty much ask whatever they want. If you pay it and later discover you have been screwed, you can’t hold your sales agent responsible. He probably didn’t know either and he has no insurance to cover your loss. All you can do is sue the seller. Good luck! This will cost you a lot of money and the result is undetermined. Only death and taxes are certain.

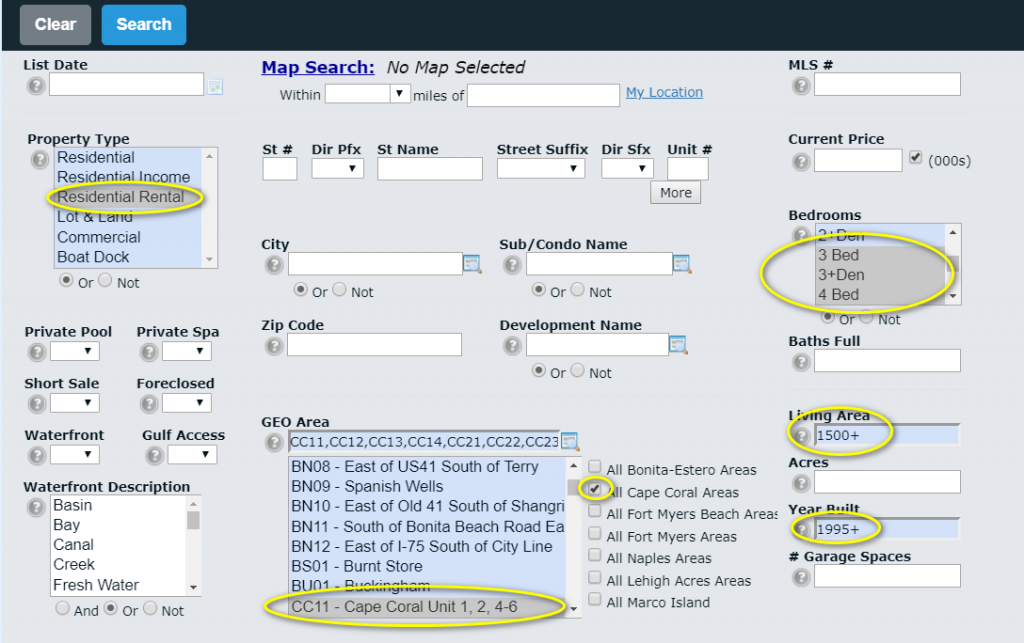

Thank heaven for our MLS

I recall it was tried many times to establish the MLS ( Multiple Listing System ) in Europe but Brokers with good listings never put them in because they didn’t want to share their commission. Since there is no real Estate Commission who could force Realtor to get educated and force them to put each listing in the MLS , it is needless to say Europe is still the Wild West when it comes to buying and selling Real Estate.

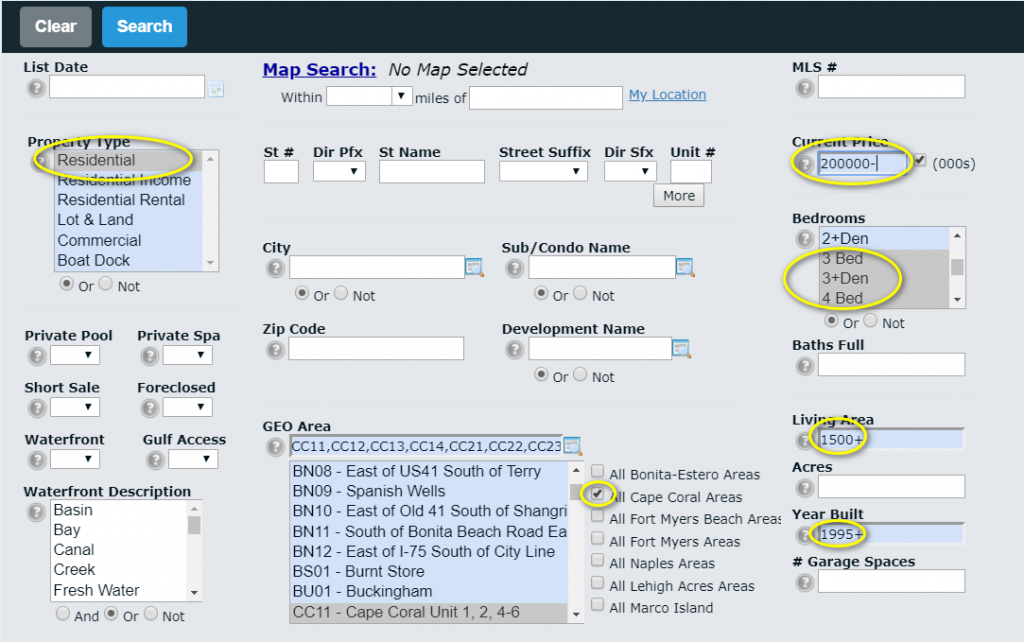

US sales agents have to put every listing in the MLS and EVERY agent in the area has access to all of them. All the time. 24/7. As a buyer, you can work with any agent. Does this mean we are all the same? Heck no!! As in every market and job, the experience is extremely important. Although buyers don’t pay commission they should still do their due diligence and research the agent they want to work with. In the end, your gut feeling will still be a huge influence, but even the worst agent has sold properties in our area.

Sellers agent:

It’s a totally different picture when looking for an agent to sell your property. Let the rookies get their experience with someone else. Here we are talking about YOUR money. We make it look easy to tell you how much your property is worth, but it isn’t. An experienced Broker has different strategies on how to approach your sale. Since you are paying this agent, go and look for a good one. Research is absolutely necessary.

Facit:

Europeans need to understand the differences in the 2 systems. Sales agents in the US are different in education and reputation. As a buyer, you are only represented when you have your own sales agent. The seller’s agent has no reason to get you the best deal. He only represents his customer – the seller. He is not obligated to tell you everything. As a buyer get your sales agent and rely on him to get you the best deal for the best price. And if this agent messes up and something goes wrong, financially you are still safe thanks to our liability insurance. As a seller: Don’t try to save a few bucks and do it yourself: it ain’t worth it. Experience comes at a price. A price you have already saved and used when you bought the property.

Find out if I might be a good fit to represent you in your transaction while checking out my resume @ https://floridasouthwestrentals.com/about-us/