Please don’t expect a guide where I tell you what to do or whatnot. This guide is supposed to support you with the tools for you to file a fact-based decision in this volatile market situation. I’m honestly waiting for a market correction since the Corona Pandemic hit us beginning 2020. Everything pointed to a correction then, but I’m man enough to tell you I was wrong back then. Now everything is still or even more pointing the same way, but I’m not telling you what you should do. But I can provide you a few stories I heard and information I got my hands on, that will help everyone to come to his own conclusion:

We are in a sellers market!

No question: we really are. Demand and supply regulate every market and our supply is dramatically down Equals: Prices are going up. Here comes an overview for what I’ve looked and what I’ve compared in the upcoming slides.

TMI – Too Much Information can hurt and confuse. I will therefore limit my information to the kind of properties most of MY buyers had purchased in the last 15 years through me. These are 95% Single Family Homes and a few Condos. ( HOA fee often make it hard to use a Condo as a vacation home or as a shorter-term investment ) I will only look at properties with at least 3 bedrooms but I don’t distinguish how old they are or how many bathrooms they have. I will show you the following slides marked in YELLOW in my video below:

You are already too late:

This is the message I got when I tried to place a CASH offer on a Single Family Home for nearly $500.000 that was listed in the MLS the same day. The seller’s agent already had 2 other cash offers. One of the buyers had already offered more than the asking price.

Yes, but this was yesterday:

One of my buyers was interested to purchase a brand new Duplex in Lehigh as an investment. New Duplexes come with a warranty and offered a seriously good investment income. He was interested in a Duplex under construction since his investment was still locked up for another 2 months. The home was listed for $325.000. I send the full price offer and received a counteroffer for $400.000. Immediately I thought the agent had mixed up homes., but he was serious. Material, as well as demand, had gone up THAT much so he was now asking $75.000 more. The worst: He had an offer already.

That was fast:

I listed a really nice Single Family Home for $895.000 and 2 minutes later ( I’m NOT exacerbating ) my phone rang. The buyers agent was in the area with his client and they asked to see the home. I got a cash offer 30 minutes later and they offered more than we had been asking. I closed this deal a few days ago and both parties are happy.

Time to investigate what’s going on:

These are only a few stories I either experienced or heard from other Realtors. Since I have a few more buyers lined up interested to purchase something I needed to put some serious hard evidence to what is going on. Here it comes and I promise it will blow you away:

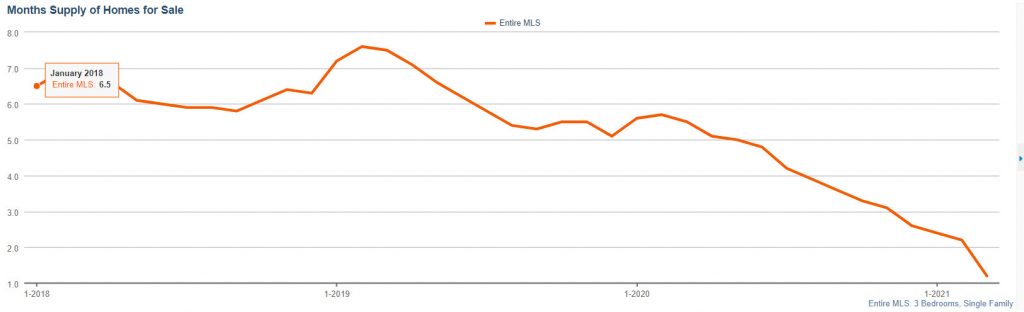

1: Supply – Single Family Homes:

This chart shows how many months the current of Single-Family Homes in all price ranges, all sizes with 3 bedrooms in all ages and no matter how many bathrooms will last. We went down from 6.5 months back in January 2018 to only 1.2 months in 2021. Condos with 3 the same criteria went down from 9.9 months to 1.6 months.

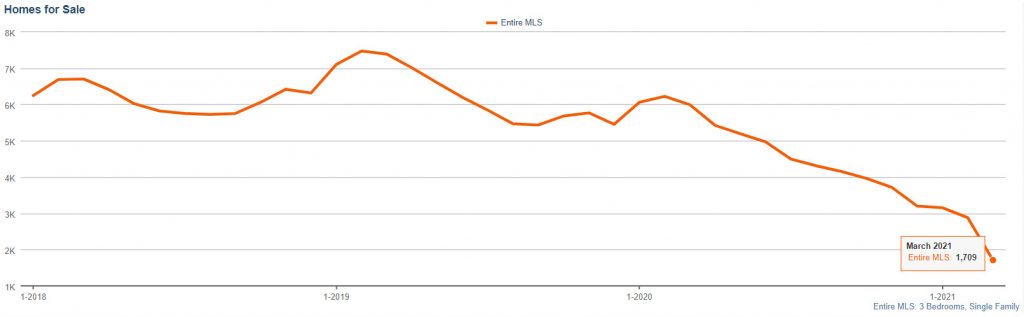

2: How many are on the market?

As of March 2021 we had 1,709 Single Family Homes with 3 bedrooms in all sizes, all bathrooms and all price ranges on the market. This number is down from 6,246 in January 2018 and 7.476 from the peak in February 2019. Since then we are on a continuous decline in supply. Condos with the same criteria went down from 2,702 in January 2018 to currently 708.

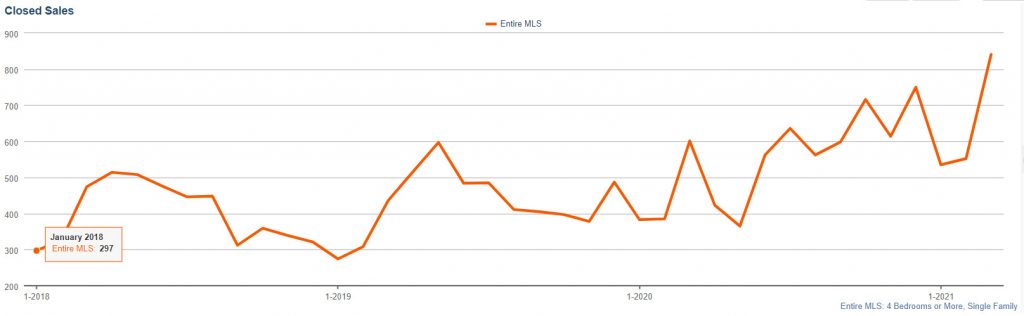

3: Has everything really sold?

It looks like!! While only 297 SFH with 4 or more bedrooms in all price ranges sold in January 2018, we are now up to 841. In this chart, you can clearly see when the Pandemic hit and people thought the market might tank. The trend is similar again with Condos and 3 bedroom units.

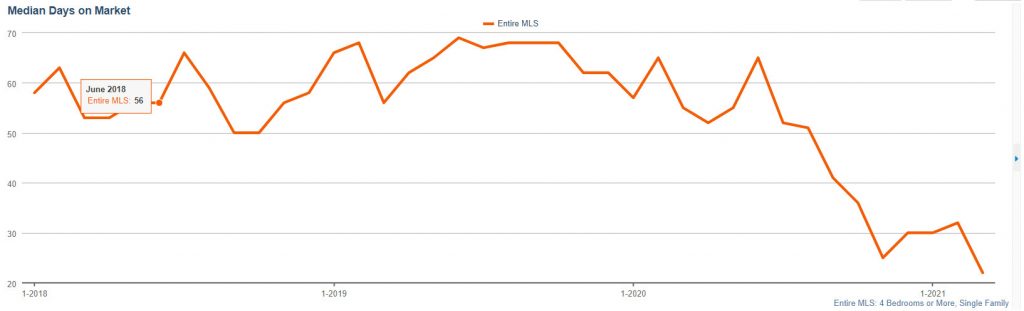

4: Does it really sell this fast_

Yes, pretty much everything sells quickly. While it took an average of 58 days to sell a 4 or more bedroom home in January 2018, it now only lasts 22 days. During peak season it took 69 days. 3 bedrooms homes go even faster: On average they are only 10 days on the market before someone buys them. During the buyers market beginning 2019 it took about 60 days.

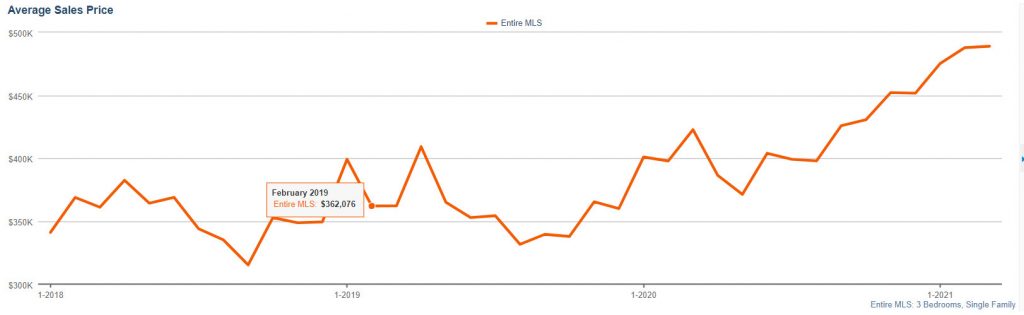

5: And finally: What about pricing?

After seeing all the above, you must know prices went up. Let’s take a look how much:

Quite some price increase: While the average sales price for 3 bedroom homes in January 2018 started at $341.073 we are now at a new peak of $488.992. All 4 bedroom homes in the same period went up from $767.867 to $1.341 Million. 3 bedroom Condos had been different: They on average sold for $632.629 in January 2018 and now you can purchase them for a little less at $614.482.

Now what? Still buy or not?

I don’t have the silver bullet and my connection to the guy up north isn’t reliable either. I can only speak for myself and as an investor: When prices go up like this while rent payments can’t keep up with the pace, my return goes south. For everyone who is in the business looking for an investment only, my advice is WAIT.

How is the rental / Vacation rental market?

( Regular ) Europeans aren’t allowed to travel to the States for over one year now. There is light at the end of the tunnel these travel restrictions might come to an end in the foreseeable future. I was just asked by a European customer who came to Florida usually 3 times each year before the Pandemic. He asked if we miss the Europeans. My honest answer: During the last 15 months we had been busier as ever before with just US buyers and guests. Most of my colleagues can’t even imagine how to handle additional customers. All our vacation homes are booked more than before. The inventory to purchase homes and Condos is gone. We haven’t been under strict Covid restrictions. In general: We didn’t even notice a difference. Yes: US vacation guests usually only stay for 4 – 8 days instead of 2 – 4 weeks, but therefore come more often each year. No difference in income for our owners. Even better: Short-term guests don’t ask for long-term rebates. And long-term rental income for annual contracts also went up about 10% within the last 12 months. Long-term rentals and vacation homes still make sense although your return will be a little less based on the higher purchase price.

Summary:

Buying a home in Florida often involves other reasons. Making money as an investment is only one. The constant warm and sunny weather makes up for a lot of other inconveniencies. So it’s still up to you if you want to spend your winters with snow and ice from November to April or if you bite the bullet and get a residents and enjoy the great life in sunny Florida. Since 1984 I’m your Realtor for all questions you might have in buying, renting, moving and much much more. See you soon in sunny paradise