I didn’t ask IF the market is going to crash again. I also didn’t ask WHEN the market is going to crash the next time. We all know the answer to this. This time it’s easy. This time it’s obvious. The market will probably start going down by the end of April 2020 and crash max. 2 months later.

Why?

Well: Because this time we can’t avoid it. This time the signals are clear. There are several reasons:

- a lot of people can’t work = they have no income = they can’t pay rent or mortgage

- Owners who have financed their properties and who are not receiving rent payments for a long time might face trouble with their lenders. As long as owner pay their mortgages out of their pocket, they are fine, but they might also be out of work……

- I don’t think anyone believes the unemployment numbers we get from the media. If you assume they might be higher, you are probably right. This does not help the market

I agree: we all need to live somewhere. We need a roof over our head although we all know with this crisis this won’t be happening for everyone. A lot of people will lose their homes. It’s not their fault, but no matter what it’s going to happen. So what do I think how bad will it be?

Let’s see:

The stock market has crashed because a lot of people needed cash. They needed it quick to fulfill their short-term obligations. OK: that’s done. All sold – most often with big hits. The lucky ones have covered this month, but this crisis ain’t over yet. The stimulus package with $1,200 per adult plus $500 per child won’t cover most people’s expenses in April. Banks and lender MIGHT be a little lenient when payments are due, but in the end, they want their money. Comes the next payment, most people will be out of money. That’s why I say the market will go down a little by the end of April and continue to go south faster after that.

Let’s look at the numbers:

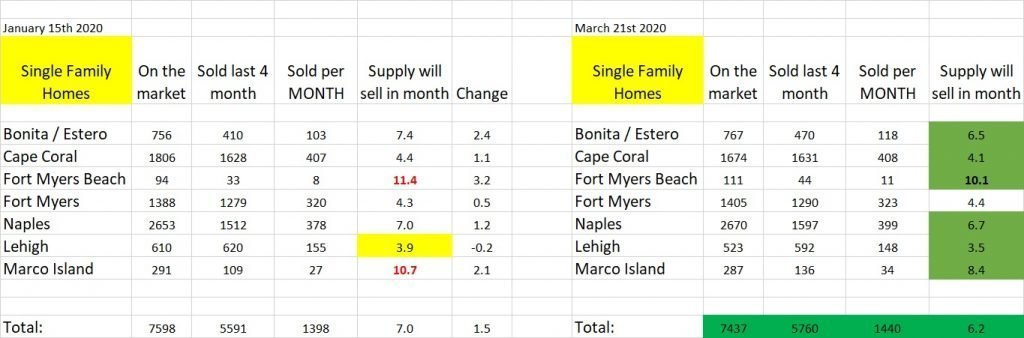

Readers of my blogs know, I’m doing a regular check how many properties are on the market for sale right now, how many have sold in the last 4 months and with this going create, how long will the supply last. The more properties are on the market and the less sell, the more prices will drop. So let’s take a look at the last 2 months. My last statistic shown on the left was performed on January 15th while the one on the right as performed March 21st. Remember: Back then we didn’t take this crisis really seriously yet.

This one looks like we don’t have a problem. Right: Not yet!! Of course, these numbers are correct and also expected. In a normal world, we have season at this time of the year. Our population nearly doubles. Lots of snowbirds are around. They got money and usually, they purchase properties. All completely normal. We even had less supply and slightly more sales than 2 months ago. Prices were going UP!

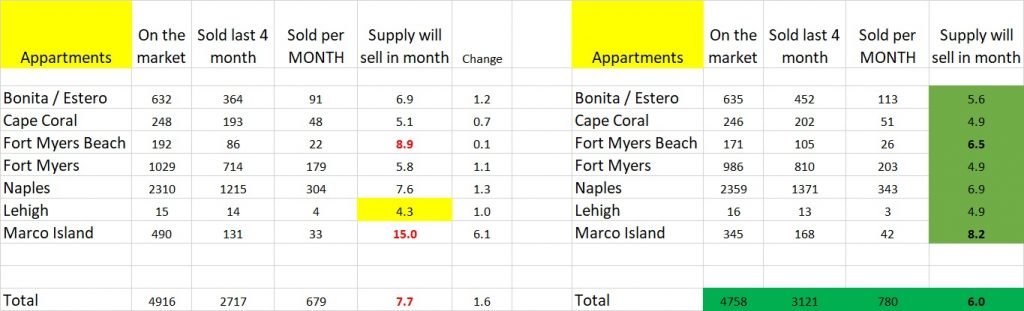

Same with apartments:

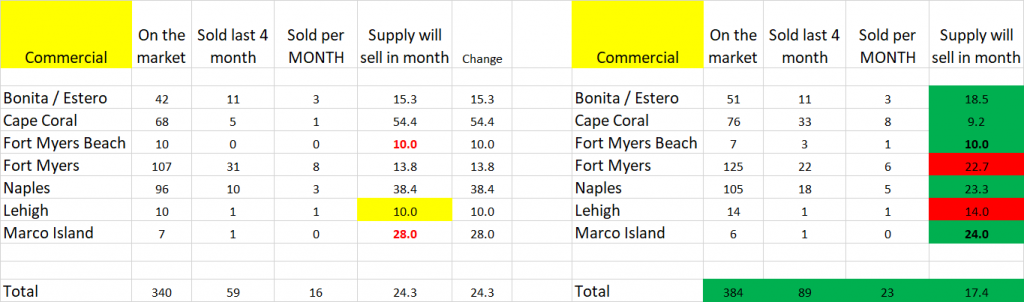

Less supply than 2 months ago ( 4916 vs 4758 ) but more sales ( 780 vs 679 ) Of course prices went up! I think the first and probably the biggest downturn will be seen in the commercial market. Right now everything is still ok, but:

The supply in Fort Myers went up. This happens sometimes even during normal times, so I won’t put too much thought into it. And Lehigh ( also shown in red ) isn’t a decent example for commercial real estate, because the supply is way too low to give us decent data.

OK: The world was still ok…..

Remember: This was a fact-check performed March 21st. Now we wait at least another month. ( I will do one in 2 weeks anyway.. ) If I’m right, then supply will go up and sales will go way down. I’m 100% sure sales will go down by then although the supply might also go down. Sellers who don’t need to sell no matter the price will take their properties off the market if this happens.

What does this mean for you if you are an investor?

This crisis is bad. They can be good for you though! The FED and all banks around the world are pumping money into the market as never seen before. FED and world banks worldwide interest rates are at ZERO and this is as low as it can get. It didn’t help the market this time. For the last crash in 2008, the banks were to blame. The had f…ed up. The FED had to intervene to support the banks before the problem spread to other markets. Mostly people invested in Real Estate were involved. The rest of the population had money and income was flowing. No other market was affected. You could buy toilet paper everywhere. No shortage.

This time the whole world is the problem and the banks will feel the impact a little delayed. Right now we are still all kind of ok. The little money most people have is sufficient to cover the necessities for food. All other stores are closed anyway. Supply is not affected yet, but the longer it takes to reopen the economy, this will happen. If we then open the economy and we have a shortage of supply in many areas, prices will go up drastically. A lot of demand hits only little supply. This law will apply and this means we will go towards inflation. How bad? I don’t know. Nobody knows, but this can be the one that erases most of your money.

Therefore:

Wait and keep checking the market. When you see prices go down start buying. Material value will beat the monetary value. Yes: You might see values even go further once you decided to buy, but they never go to ZERO as your monetary value might. It happened before. There is no reason it will not happen again. Don’t lose your money. Invest in material values. Invest in Real Estate. I still own a few properties which I bought for pennies on the current value. The rent I receive has paid them multiple times since then. Do the same next time. Most of my values have tripled since 2008. I don’t really care too much if they will suffer a little in this crisis. I will start buying again if the market feels right.

I will let you know….

Keep reading my blogs and I will let you know when I get back in the game. Then it’s up to you to either do the same or not. I’m making money helping you to invest and make money. This is a win-win situation.

I live in Florida since 2004. As a real estate agent, I am not allowed to provide legally binding advice when it will be the best time to invest in Real Estate. I’m in this industry my whole life. I’ve seen the market turn in both directions multiple times. I’ve invested my own money and I tell my friends and customers to do the same. I don’t know if I will be right all the time, but one thing I can guarantee 100%: The market will return. Either with you or without you. If you are interested in our services, please feel free to call or email me any time.