The Dow is surging, and that’s supposed to be awful news for the housing market which is completely disconnected from the real economy. In addition, the U.S. stock market appears to be diverging from the housing sector as well.

After the release of the ( obviously slightly manipulated ) better job report a few days ago, the Dow rose. Although slightly fallen since then, the Dow has soared about 40% since it had hit bottom.

But what’s good news for the U.S. economy is awful news for the housing market. Indeed, the risk-on rally has caused Treasury yields to spike. The employment report fueled the growing selloff in the bond market, pushing the Treasury yield above 0.9%, its highest since March. As mortgage rates follow the yield on the 10-year Treasury, they have risen this week, after sitting around record lows in the past two weeks. The average interest on a 30-year mortgage was 3.18% this week.

In addition, lenders have tightened their lending practices making it harder to be approved for a new loan with only a little or sometimes even no down payment at all. Interest rates climb, customers are supposed to bring higher down payments, unemployment is at all times high and the Corona Pandemic is sneaking back into our lives again with possible shutdowns just around the corner. This is a recipe for a guaranteed disaster for the housing market and it has to fall sharply. Well: Not yet.

Facts not suppositions

Readers of my blog know I’m regularly checking our local housing market. Supply, demand, and sales are easy to compare to previous months thanks to our MLS software. So let’s compare a few facts with previous months:

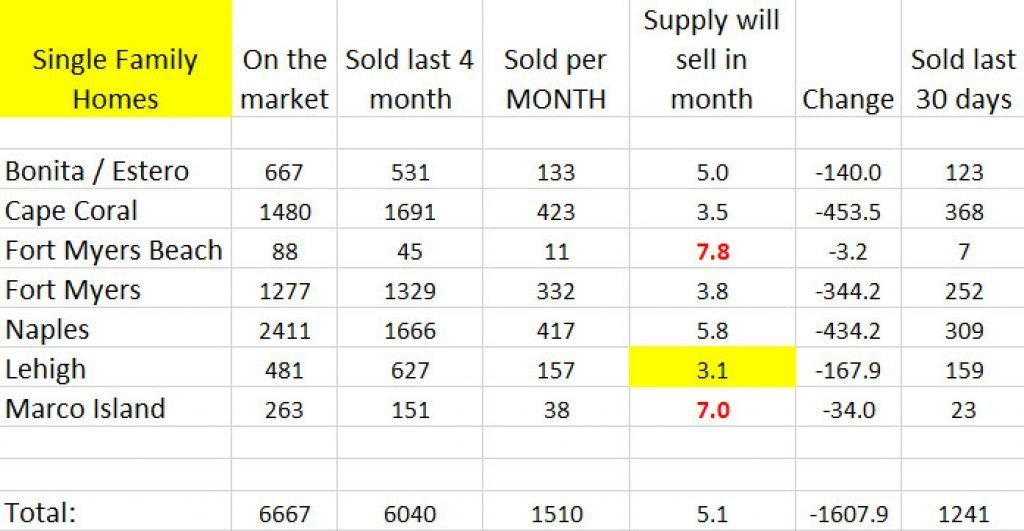

May 2020:

How to read this list:

- These are ALL Single-family homes in Lee County

- In total there were 6,667 homes for sale 30 days ago

- 6,040 have been sold within the last 4 months while only 1,241 have been sold for the last 30 days. The 30-day comparison already gives us the first clue. Multiply 1,241 by 4 and you end up with only 4,964 sales instead of 6,040. This states sales are declining.

- Supply should not last longer than 6 months with the current sales/month. Numbers in red are concerning – numbers in yellow are encouraging.

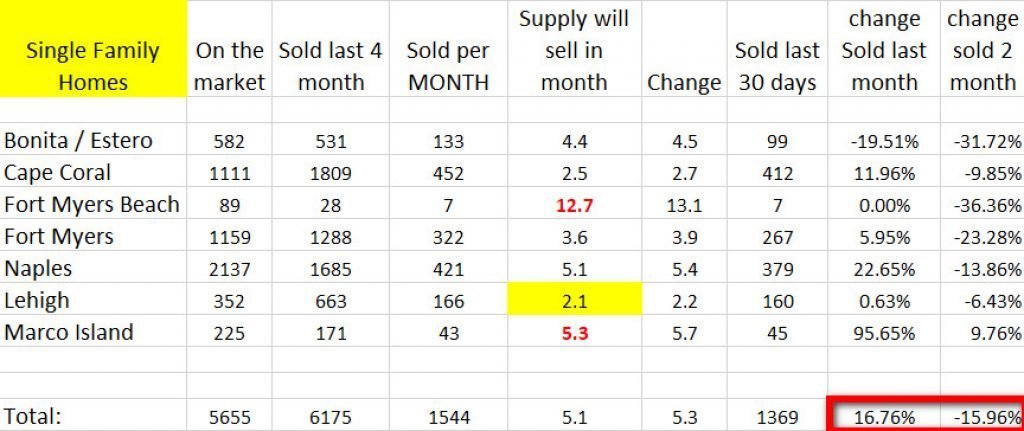

Now look at the same list 30 days later:

These are the changes you need to look at:

- There are over 1,000 homes less on the market for sale

- But within the 4-month comparison, 135 more homes sold

- And within the 30-day comparison, even 128 more homes sold

- In overall sales have increased to 16.76% compared to the last month

- Compared to 2 months ago when the Corona Pandemic was much worse, we are down only about 16%

That’s not a market in Turmoil -right?

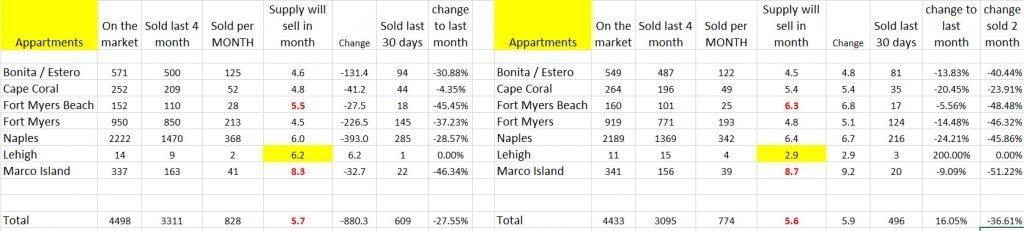

Let’s take a look at apartments with the 30 day comparison side by side:

- Supply is nearly the same

- The 4-month sale is only down slightly, but the 30 comparison shows 113 sales fewer.

- Neglect the 200% uptick in Lehigh. There are only a few Appartments at all. But overall, the market is only still pointing down slightly.

- Compared to 2 months before, the overall sale is only down 36%.

With everything that’s going on, you should expect a much sharper downturn. These numbers are proof this isn’t the case – yet! So far, sales are still going strong.

What about prices – are they falling?

Remember: When Corona hit the States, lenders knew what was going to happen. People who are losing their jobs when businesses are forced to close often can’t pay their mortgage. Banks learned their lesson during the last crisis in 2008. This time they acted quickly and allowed homeowners to postpone mortgage payments for 3 months. 3 months later they extended it another few months. We are still in this extension. This explains why prices are not dropping as rapidly as you might expect.

So: Will prices drop eventually?

Let me answer this with a question: What do you think? Is there actually any chance they won’t? If yes, please explain this to me and my readers. If it walks like a duck, quacks like a duck, chances are good it’s a duck. In my opinion, prices have to come down once either the Government doesn’t extend these payment delays or if the job market doesn’t approve dramatically. I see none of these in the near future which has to lead to prices going down.

WHEN????

I have no idea, but soon. Investors, please be patient a little longer. I’m in touch with many of you already and I will let you know when I see clear signs to get in – when I will get in again. Until then: Watch the market and forward me your thoughts.