The Corona Pandemic has hit our area. The Pandemic has of course hit everywhere but the symptoms and problems related to it aren’t easily visible. Looking at the traffic on our roads you don’t think anything has changed. Try to get a table at ANY restaurants in our area on a Friday evening: Good luck! All but the bad one’s are completely booked and you need to bring time to get a table. Do we really have a Pandemic? Does anyone think about all the people dying each day? Nope! No masks in restaurants – just the tables “seem” to stand apart a “little” further as usual. Drink, laugh and spread the news ( virus ) as much as you want. The stores and of course our beaches are as busy as usual during high season. We don’t even notice neither Canadians nor Europeans are “legally” allowed to be in our area. So it’s all Americans and they enjoy being in the Sunshine State.

And they keep buying properties

Before I get to the private market, let’s take a look at the hardest hit market: Commercial! To be honest: We’ve never been an area where big industry had their eyes on. We are a vacation hotspot and only smaller commercial businesses ( except Restaurant chains ) had a chance being successful. Now my list with the overall market supply and demand comes in handy. This will show us what’s going on. Let’s take a look.

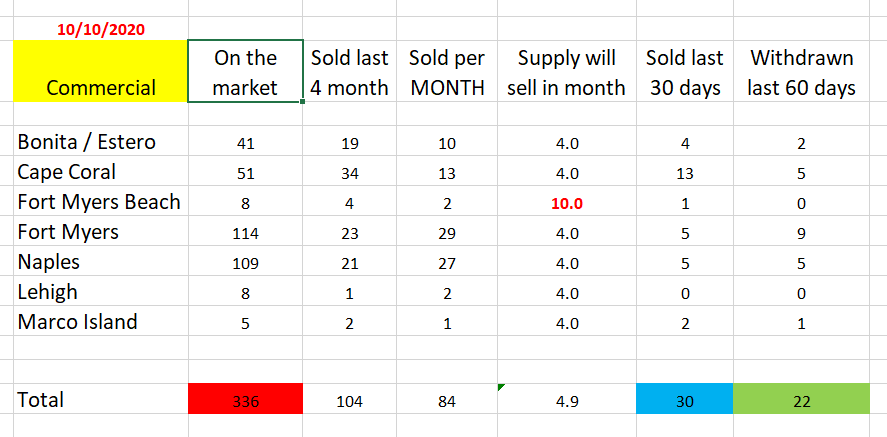

Commercial as of October 10th 2020

For an easier comparison, I’ve color coded the most important issues. End of last year, we had 336 commerical properties for sale. About 84 sold if you devide the “Sold last 4 month” row by 4. But I also looked at what was sold in the last month ( September ) only and the number was down to 30. This was a clear sign the demand is gowing down. Only 22 properties had been withdrawn from the market between August and October. That’s about the usual average.

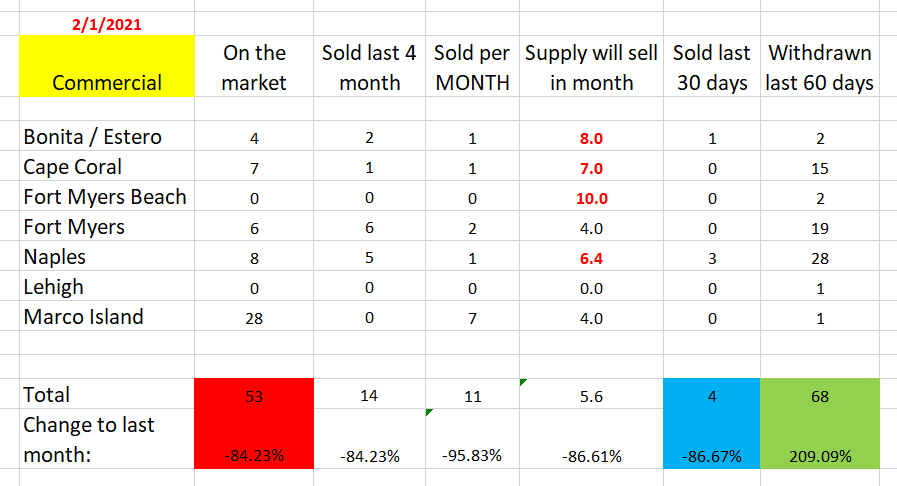

Same list as of February 1st 2021:

Oh boy: The signs are clearly visible: Instead of 336 properties for sale, we went down to 53. Not 84 per month in average sold and the last month instead of 30 only 4 changed hand. That’s about 86% fewer sales and this is met by about the same percentage of fewer supply. But on the other hand, 68 compared to 22 had withdrawn their listings. That’s an increase of over 200%. That is not the normal pace. With the Pandemic there was simply no demand for commercial Real Estate. Period. I guess this explains why a lot of people lost their jobs. In our area there aren’t too many “Home Office” jobs.

Let’s look at the private RE market:

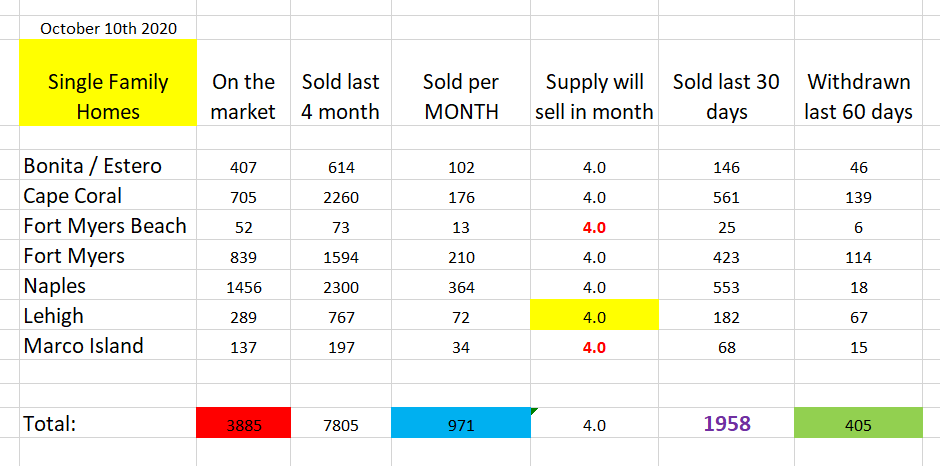

This is a look at ALL Single Family homes in our area. This is how a healthy market looks. The supply in general lasts 4 about 4 months. But the 1958 homes that sold only in the last 30 days clearly stated a big buyers market. Prices went up although the supply still came in. I was seriously wondering when we would see prices drop because of the Pandemic. But look what happened instead:

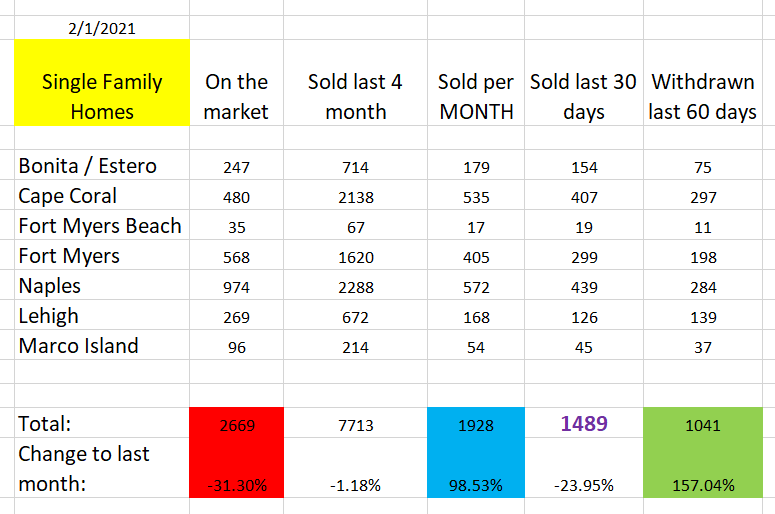

Single Family Homes February 2021

The supply went DOWN. The average sales only went down 1.18% but the “sold per month went up 98%. Of course prices went up because on the other side 157% more people did withdraw their listings. These guys didn’t read my newsletter and I assume they expected the market to drop like I did. But I had the facts and I could tell and prove to my clients what’s going on and what’s going to happen in the close future. Now I see sales in the last 30 days going down about 24%. Although this is normally not a big reason for concern, I guess this time it might be. Remember: These are numbers of January. That’s already season. But we need to wait and see the numbers of February which is our strongest month of our season. If this number sharply declines again in February, then that’s the sign for the market to turn. Stay tuned next month.

A few words about myself at the end:

I’m in Real Estate since 1984 and now I can say I’ve seen it all. Normal markets, crazy markets, and now even a market during a health crisis. There are hundreds of Real Estate agents in our area. You won’t have trouble finding one you like, but you should also weigh in his or her experience. You probably won’t find a highly sophisticated 20-year-old with my 36 years of experience. Passing the exam does not automatically mean you know what’s going on and how to treat your clients. Check the background of the Realtor before you hire him or her. Experience cannot be substituted with youth and looks. Call or email me any time if you think about selling, listing or even just looking at what’s going on to get an idea of what kind of adventure you are about to enter.