Usually every 2 months I’m performing a detailed market check about the supply and demand for real estate in our area. My last check performed beginning of November 2019 revealed a still healthy market of demand and supply. My gut feeling is bothering me a long time since I can see what’s going on and I wondered if the market had changed.

When driving around with customers it bugged me a long time seeing all these new constructions coming up. Especially when it comes to apartments. There are A LOT being built right now. When I was a builder in Germany, we also built Apartment complexes, but we NEVER started before we hadn’t sold at LEAST 50% of the complex. In Florida, nearly all of the new construction are SPEC Homes / Apartments. This means they are built, but there is no buyer yet. Especially in a buyers market, this can turn into a disaster.

Is it a buyers market again?

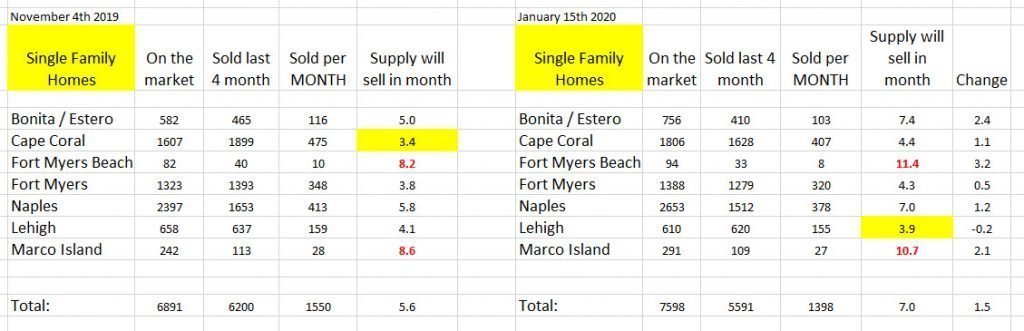

It’s a buyers market when the supply dramatically exceeds the demand. In order to find out if it got better or worse, comparing the numbers from 2 months with the current supply I think we are getting there!! These are numbers from single-family homes that aren’t located on any waterfront

And the winner is: LEHIGH

This confirms the reports on TV and on the web: Lehigh as the fastest growing City in SW Florida. It’s no longer this boring town off everything. It’s getting big, but it’s still the place where you can get the most for your money. It was the only city where the supply shrunk. In all other cities, supply grew. The next chart shows single-family homes again, but this time waterfront:

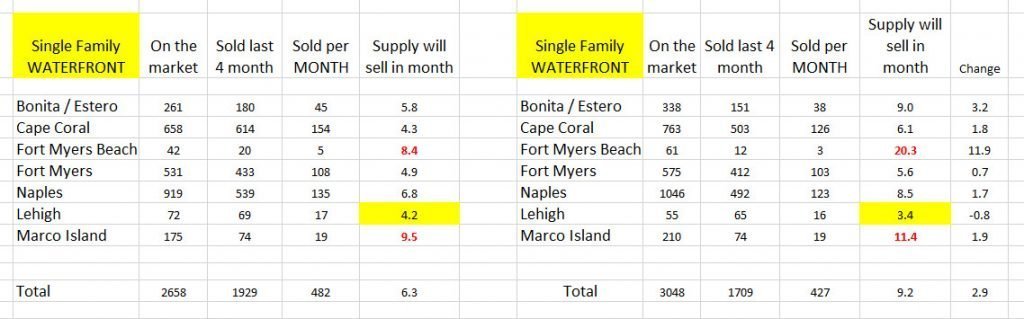

And the winner is Lehigh again

I agree: There aren’t too many homes in Lehigh sitting on any kind of Lake or Canal. BUT: If you can get one: Buy it. Lehigh again is the only city where it took less time to sell the current supply. Let’s take a look at apartments:

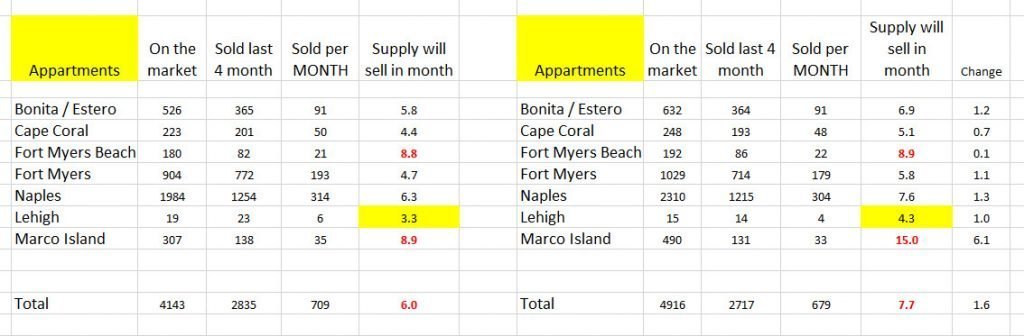

It wasn’t just my gut feeling: Supply really went up!

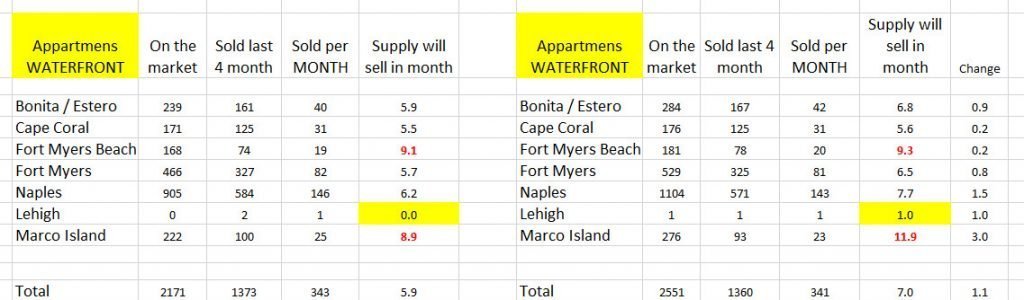

Supply went up nearly 20% within the last 2 months. This is the result of some of these complexes under construction are hitting the market. But we aren’t done yet: There are a LOT MORE apartment complexes under construction that aren’t considered in the chart. I assume my next comp in 2 months will look even worse. But now take a look at Apartments that are located on some kind of waterfront:

Result: Bad, but not as bad as “off water”

Here we are up 18% in supply and it will take 20% longer to get rid of the supply. This is, of course only if there are not too many new hitting the market. And keep under consideration, that it’s the season: Right now a lot of Snowbirds are here and since our population nearly doubles during this time, so might demand. But season sure ends in about 3 months and then what? Supply as I see it won’t.

Are prices already going down?

Honest answer: No, not yet, but this is to be expected. During the season this won’t happen, but these builders need the money from these sales and the closer we come to the end of 2020 season, I expect some to drop the price or offer other incentives. This could be the start of the downturn.

So what about Commerical then?

Commercial is everything that’s NOT residential. The statistic is not so easy to read since too many different property types are in this list. There are business parks next to warehouses next to gas stations next to malls next to car dealerships. Each of them has a different clientele. The chart would be way too complicated if I spilt it up, but after all these years in this market I can tell you one thing about Commerical real estate as an investment:

Don’t do it!! Or better: Hell no!!

I can personally show you properties that are on the market for YEARS. Right: Years – not just months. There is an office building I know on the market since 2016 and a car dealership right next to an off-ramp from I75 in perfect location vacant for more than 2 years. So unless you need a perfect write off where you nearly guarantee to lose your total investment: Well: Then go for it.

So now what: Am I telling you not to invest in Real Estate any more?

Of course not. All I’m telling you is to be a little more careful. Another crisis is somewhere on the horizon. How fast and how bad will we be hit? Ask me AFTER we have been hit since nobody knows. But waiting and doing nothing until we got hit and prices are dropping is also not a good investment. It might still take years where you can get a good return on your investment. People waiting for “The perfect moment” to get in or out of something usually never do anything.

Summary / Conclusion:

The rental market is going strong. In a real estate downturn, a lot of people will get hit. They will lose their home. These people need to live somewhere. Your rental home will make you money until a crisis hits and even more once we have been hit. So please feel free and take a look at our MLS system on my website. Go to “Homebuyer” and chose Option 1 or 2 to look if there is something that catches your eye and your wallet. I’m happy to assist you whenever you are ready.

About my background: